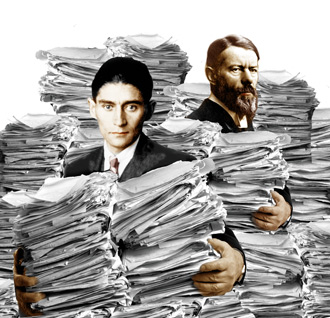

Anyone who has ever applied for a loan… no, strike that – anyone who has ever applied for ANYTHING knows how much a timesuck the application process can be. It’s almost as bad as that paperwork they give you to fill out in the doctor’s waiting room.

Anyone who has ever applied for a loan… no, strike that – anyone who has ever applied for ANYTHING knows how much a timesuck the application process can be. It’s almost as bad as that paperwork they give you to fill out in the doctor’s waiting room.

Fill this out, fill that out, provide a copy of this, provide the original of that, submit a pay stub (maybe even two pay stubs), and then give up the contact information for all your friends and family. And that’s the short-form version of the application process!

No matter if it was for a loan, a credit card, or a bank account, applying for anything in the financial field is usually a nightmare. And so it is particularly surprising when someone simplifies that process, and finds a way to make it quicker, more efficient, and paperless.

You Read That Right – Paperless Loans

Wait… what? Paperless?

A paperless loan application?

Isn’t that like a unicorn, or a leprechaun? A creature of legend and myth, long fabled but rarely glimpsed by human eyes.

Not at all. In fact, since payday loan companies began using this innovation several years ago, it has revolutionized how people view the loan application process.

For tech-savvy lenders that want to respond to customer demand, paperless applications have been available for several years now.

For a paperless payday loan or cash advance, the entire application is online. You fill it out (and can even save the application if you need to leave and return to finish it). You do not need to submit a copy of your Social Security card, your photo ID, or anything else. Payday lenders will verify your identity. If anything else is needed, you can also submit that electronically.

For example: the lender requests a paystub from your last payday. You can email them the electronic document, or just take a picture of the paystub with your phone and submit that. No paper required.

Once the application is complete, you can view your loan contract online, approve it with your electronic signature, and hit submit.

When approved, the payday loan amount goes directly into your bank account. When it is timer to make payment, you submit an online payment request, and the money is transferred out of your account.

Using a paperless application frees you completely from any restriction on when or where you can apply. From your phone, in the middle of the night; as long as you have a signal, you can be approved for a payday loan.

Using a paperless application frees you completely from any restriction on when or where you can apply. From your phone, in the middle of the night; as long as you have a signal, you can be approved for a payday loan.

The only real problem will be dragging that now-useless filing cabinet out of your office!

Why Doesn’t Everyone Go Paperless?

Every financial institution and every payday lender could offer paperless services. After all, was that not one of the main selling points for the rise of the computers? Thanks to Macs and PCs, electronic documents can completely replace paper, and legally they are just as binding. So why don’t more places go paperless?

Having something printed out on paper is a holdover from the “old” days, when it was necessary to have proper documentation. Those days are behind us (at least in this country) but most people are still conditioned to only feel safe if they have something they can hold in their hands.

And for these people, a paperless application is still the right answer. “Paperless” means that no forms or physical documents are required. There is still the option to print out the application, the terms and conditions, the contract, and all repayment receipts. Lenders will give you the opportunity to print out all of these things for your home records. You just don’t have to.

Now how’s that for being Earth-friendly?

Similar Posts:

- Payday Loans and Banking

- Easy Payday Loans: Can They Help?

- Overview of a Cash Advance Payday Loan

- Easy Loan NO FAX Required

- The Benefits of No Fax Payday Loans

Monday – Friday from 9:00 a.m. to 12:00 a.m. EST

Weekends from 9:00 a.m. to 6:00 p.m. EST

Our website is accepting applications 24-hours a day, every day of the year